Implemented in 2018, the real estate wealth tax ( ‘Impôt sur la Fortune Immobilière’ IFI) replaces the solidarity tax on wealth (ISF) in France.

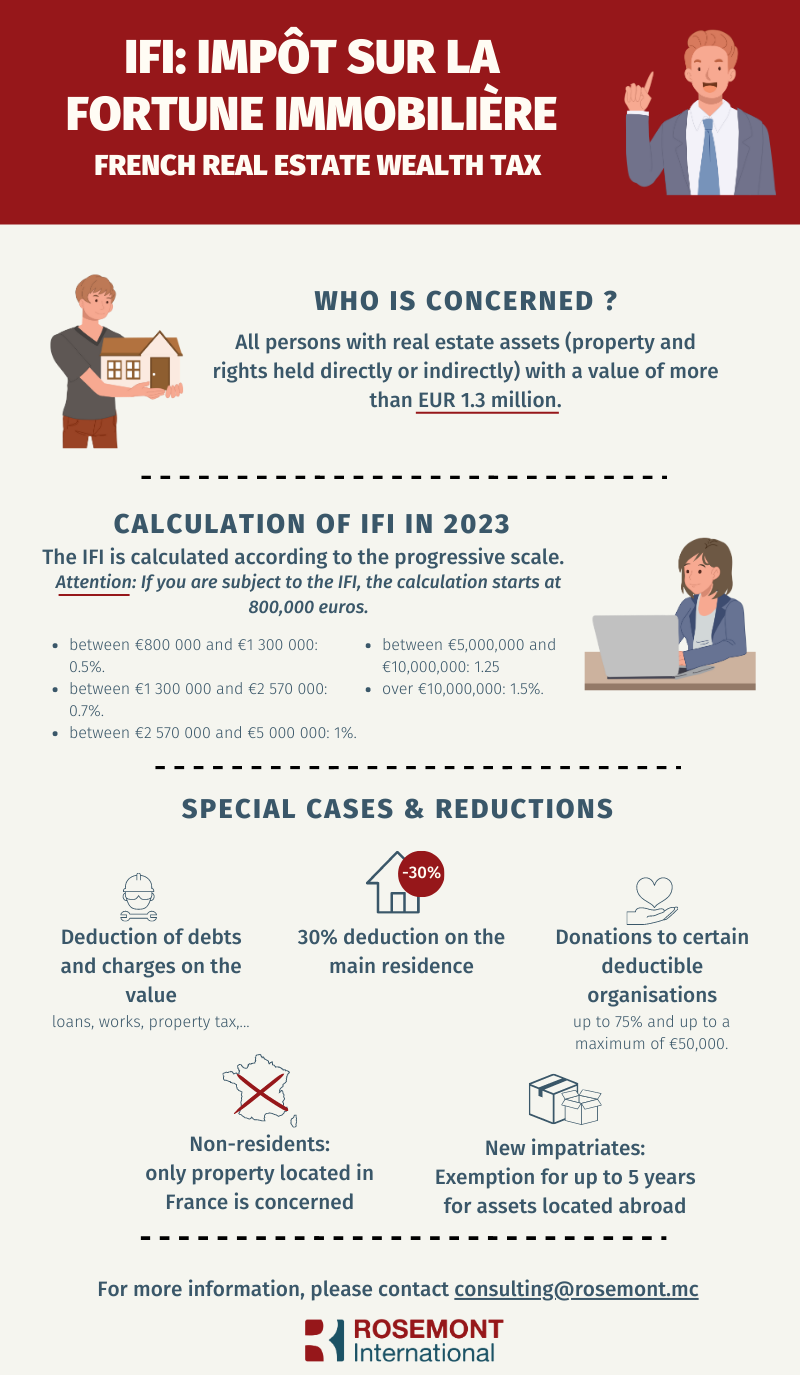

Discover our infographic to understand the IFI.

Our team of qualified and experienced professionals can assist you in tax planning or guide you in structuring the acquisition and holding of your real estate assets.

Disclaimer: This summary is provided for information purposes only, we recommend that you seek the advice of tax experts such as Rosemont for further information on French or international real estate taxation, or to consider the structuring of the acquisition of real estate assets. For more information, please contact consulting@rosemont.mc

Understand the French real estate wealth tax (as of 1 January 2023):

1. Who is concerned by IFI?

Any person with a real estate asset worth more than 1.3 million euros could be subject to IFI.

2. The assets concerned

As the name suggests, only real estate assets are subject to tax, that is, built or unbuilt buildings, real estate rights, shares or stocks of real estate companies* of the person liable to the IFI or of the members of his tax household.

*Note: if a shareholder indirectly holds less than 10% of the capital of a real estate company, the value of the real estate will not be taken into account when calculating the IFI.

-

shares in listed real estate companies if the taxpayer holds less than 5% of the capital;

-

traditional UCITS and alternative investment funds are also exempt from IFI in cases where real estate assets account for less than 20% of total assets

3. The calculation of the IFI

Taxation is calculated per tax household (note: a person living alone constitutes a tax household) except in the case of :

-

spouses married under the regime of separation of property: the spouses will therefore be liable for their personal assets only;

-

spouses in the process of separation or divorce.

The IFI tax threshold is €1,300,000 of net taxable assets. If you are liable for IFI, the calculation starts at €800,000.

The tax rate varies from 0.5% to 1.5%, divided into six brackets:

-

From €800,001 to €1,300,000: applicable rate of 0.50%.

-

From €1,300,001 to €2,570,000: applicable rate of 0.70%.

-

From €2,570,001 to €5,000,000: applicable rate of 1%.

-

From €5,000,001 to €10,000,000: applicable rate of 1.25%.

-

Above €10,000,000: applicable rate of 1.50%.

4. Special cases and deductions

There are 3 cases to consider:

-

If you are a resident of France for tax purposes, and you own your main residence in France, you will be able to benefit from a 30% deduction when calculating the IFI

-

If you are a non-resident, only your real estate assets located in France will be taxable.

-

If you are a newcomer to France, you will benefit from a 5 year tax exemption (following your date of entry into France) on your assets located outside France. This is only valid if you were not domiciled in France in the 5 years prior to becoming a French tax resident.

Please note that, as with all taxes in France, you can also deduct up to 75% of your donations to certain organisations from your IFI, up to a limit of €50,000.

5. Deductible liabilities :

French law also allows the possibility of deducting:

-

Debts existing on 1 January of the tax year, relating to the acquisition of the property, expenditure on improvements, construction, reconstruction or extension;

-

Tax debts relating to the property;

-

Bank loans and debts: certain loans and debts can be deducted.